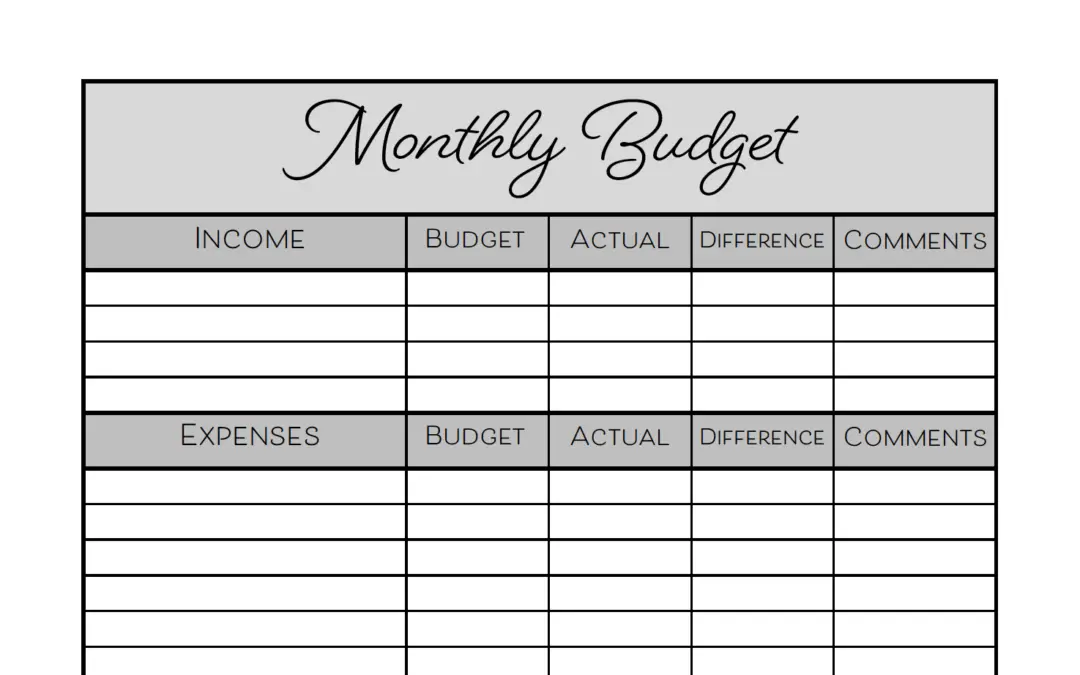

Need an easy way to track your budget? This monthly budget printable will allow you to keep track of your budget and record your income/expenses relative to your budget.

Table of Contents

Home Management Binder

I love my home management binder! It’s a great way to keep all the important information you need all in one organized place. I have created a full binder for you to print out that is cute and functional. You can click here to learn more about that full binder!

I realized that many of the printables out there are beautiful, but it can be really expensive to use full-color ink on colorful printables all the time! I am too frugal to waste money on all that ink, so I created this monthly budget printable for a more simple and clean option!

I wanted to offer more free printables in black and white because I want you to save money on ink too!

How to Use the Monthly Budget Printable

Let’s take a brief look at each column of the printable to see how you can best use it to help you get your finances in order.

Income

Make sure you include all income streams not just the income from your primary job.

- If you have a side hustle that brings in $100 a month, include this on your budget printable.

- Alimony or child support payments should be included as well.

If you have irregular monthly income than you can either base your budget off of your lowest income month from the last 12 months or base it on your average income over that same time span.

- Being conservative with your income estimate will keep you from having “uh-oh” months.

- If you end up receiving more income than your budgeted amount, great! Now you have more money to put toward your saving goals.

If you get unexpected income throughout the month like a bonus, a larger-than-expected commission check, or a gift, make sure it gets added to your budget. You’ll never truly be able to know if your personal finances are running in the red or the black until every penny of income and expense is accounted for.

Expenses

If you are just getting started with budgeting, it may be easier for you to lump certain expense categories together. For example, you could have one big $500 “Food and Dining Budget” that all food-related expenses fall under.

However, as you get more experienced with budgeting and get more dialed into how much you are spending each month, you can create as many budget line items as you want.

Instead of a large “Food and Dining” budget, you may instead want to break it down into smaller budgets, such as:

- Groceries- $300

- Restaurants- $125

- Fast Food- $50

- Coffee Shops- $25

Budgeted, Actual, and Difference

As you go throughout the month, you’ll inevitably have certain line items that you overbudgeted for and others that were underbudgeted.

Our monthly budget printable makes it easy to see how far you under or over you came in on your expenses for each line item. Simply subtract your actual amount from your budgeted amount.

- If you end up with a positive number, then you came in under budget — Hooray!

- If you end up with a negative number, then you spent more than you estimated — Bummer.

- Write this positive or negative number in the “Difference” column.

For example, let’s pretend you budgeted $150 for gas.

- If you spent $130, then you’d write $20 in your “Difference” column ($150 – $130 = $20).

- If you spent $180, then you’d write –$30 in that column instead ($150 – $180 = –$30).

Once you’ve completed your budget for the entire month, add all of the “Difference” columns together to find your total surplus or deficit for the month.

Below, is an example of the differences between four different budget categories:

- Groceries:–$30

- Gas: $50

- Clothing: $25

- Utilities:–$35

Combining all these together, you can see that there is an overall surplus of $10 (– $30 + $50 + $25 – $35 = $10).

Comments

If you ended up spending significantly more or less than you budgeted, what were the reasons that happened?

Write those reasons down so that you can decide if you’ll need to adjust your budget going forward.

Conclusion

Sometimes having the right tools is all you need to get a project done and budgeting is no different.

If you’ve been putting off the task of creating a monthly budget, our hope is that this monthly budget printable will help you get started. We’ve tried to make it as flexible and user-friendly as possible:

- If you are using a binder, there is room to 3-hole punch the sheet.

- You can also just print the sheet and post to your bulletin board or hang on the fridge as a reminder.

Click here to download the monthly budget printable completely free!