Figuring out the best debt repayment method can daunting. When you have credit cards, medical bills, student loans, car loans, and a mortgage, how do come up with a plan to payoff your debt? What should be paid off first and what should wait?

When you have several debts, it can be hard to even know where to start, let alone come up with a plan or strategy to pay off your debt. You might even get so flustered thinking about it that you don’t do anything at all. But what happens when you don’t make a plan to pay off your debt?

It doesn’t happen.

Table of Contents

What is Your Total Debt Right Now?

Before you figure out a strategy, you’ll need to know where you stand today. Don’t be afraid of the numbers. It may be scary to see all your debts on one page, but you can’t measure your progress if you don’t know where you started.

On a scratch piece of paper, list each debt including the creditor/bank name, current minimum payment, total balance owed, and interest rate. Then, you’ll need to figure out your debt payoff strategy.

When it comes to focusing on debt at a time, there are two schools of thought in the personal finance community. One group of people are avid fans of a method known as the “Debt Snowball.” Another group of people would say that the “Debt Avalanche” method is far superior.

Let’s quickly explain both strategies and then we’ll discuss the pros and cons of both.

The Debt Snowball Method

You may have heard of a Debt Snowball but didn’t know what it meant. The Debt Snowball strategy means starting with the smallest debt first and then moving on to bigger and bigger debts. As you start paying off your debts, you gain more and more momentum.

Example of the Debt Snowball payoff plan

1: Credit Card #2 – 19.99% with a $1,000 balance

2: Credit Card #1 – 15.99% with a $5,000 balance

3: Car Loan #2 – 6 % ,with a $10000 balance

4: Student loan – 7.5% with a $12,000 balance

5: Car Loan #1 – 7% with a $15,000 balance

With the Debt Snowball, if you have 500 extra dollars to pay towards debt, you put all $500 towards the smallest debt — in this case, Credit Card #2, and then continue on in ascending order.

As you pay off a debt, you can take the minimum payment you were previously making towards it each month and apply that amount towards your next debt.

In our example above, you would pay off Credit Card #2 in 2 months. If Credit Card #2 had a minimum payment of $50, you could then begin paying $550 each month towards Credit Card #1.

At that rate, Credit Card #1 would be paid off in 9 months. So in less than a year, you would have paid off 2 of your credit cards. That would feel pretty good, right?

And therein lies the secret behind the Debt Snowball — it’s psychologically encouraging to experience quick wins. When you see real, tangible early progress, it gives you momentum to keep kicking your debt in the butt.

Who it’s best for

You need the motivation that small successes bring. By starting small, you’ll see payoff success sooner with this method.

The snowball payment method is also good when you have varying sizes of debt that don’t have a wide spread of interest rate.

Downsides of the debt snowball

A debt snowball is not the most efficient way to pay off debt. You’ll pay more in interest since you are not focused on eliminating the highest interest rates.

The Debt Avalanche Method

The Debt Avalanche method involves starting with the debt with the highest interest rate first. As you pay off each debt, you move on to the debt with the next highest interest rate.

If the Debt Snowball people are all about momentum, the Debt Avalanche people are all about math. They want everyone to know that you will pay off your debt sooner and you will spend less in interest by using the Debt Avalanche method.

Example of the Debt Avalanche payoff plan

1: Credit Card #2 – 19.99% with a $,1000 balance

2: Credit Card #1 – 15.99% with a $5,000 balance

3: Student loan – 7.5% with a $12,000 balance

4: Car Loan #1 – 7% with a $15,000 balance

5: Car Loan #2 – 6 % with a $10,000 balance

The first loan to focus on is the one with the highest interest rate and last one is the lowest interest rate.

Who it’s best for

You are motivated by saving money-this method will save you the most in interest costs. This method is also great when you have similar size debts and varying interest rates.

Downside of the debt avalanche

The biggest disadvantage to using a Debt Avalanche is you may lose motivation because it takes longer to see payoff results.

Snowball vs. Avalanche

Which is the better option? The best option for debt repayment is the option that works for you.

Despite the passionate appeals from supporters of either side, for most situations, the actual difference in your results using one method over the other is slight.

- If you are motivated by meeting small goals, then stick with a Debt Snowball.

- If you are motivated by saving money, then go with a Debt Avalanche.

If you don’t feel particularly drawn to either method, then I tend to encourage people to try the Debt Snowball method first, despite the fact that the math lies in favor of the Debt Avalanche.

Why? Because let’s be honest — if you are needing a plan to get out of debt in the first place, there’s a good chance your primary problem is motivation.

Many of the people that I hear supporting the Debt Avalanche are personal finance nerds like me who shop savings account interest rates and get all excited about shaving the expense ratio on their investment accounts by .25%.

But most people who are drowning in debt didn’t get there because they were that detail-oriented about their finances. For most people, the key to getting out of debt is to just find a method that you won’t get discouraged about and give up on.

Is that to say you shouldn’t use the Debt Avalanche? Not at all!

If the idea of saving some money on interest gets you stoked and would help keep you motivated, then, by all means, use it!

The most important part is just having a debt payoff plan. Once you have a plan, you’ll be more likely to see results on your debt payoff regardless of which method is best for you.

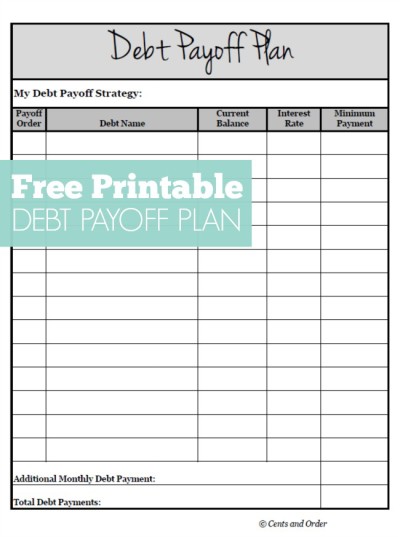

Debt Payoff Plan

Click here to download the Debt Payoff Plan printable

Once you’ve determined what strategy will work best for you, make a list with the payoff order you’ve chosen. Don’t forget to include an extra amount you will be paying each month toward your debts.

To see the most progress on your debt, be sure to keep paying the same total amount each month. When one loan is paid off, you take the amount you were paying and apply it to the next loan on your list.