Budgeting, in my humble opinion, is the anchor behind any successful financial plan. If you want to get your money in order, save more, owe less or pay cash for something big, start with by creating a budget.

A budget helps you with your finances because it helps you to know where your money goes each month. It’s very easy to just spend and then be left wondering why you don’t have any money left to save or get ahead. Budgeting helps you avoid that problem.

I know; budgeting isn’t always easy – especially if you haven’t done it before. The thought of creating and living by a budget can be overwhelming. Where to start? How to set it up in a way that works for me? There are many brilliant ways to set up, use and succeed at budgeting.

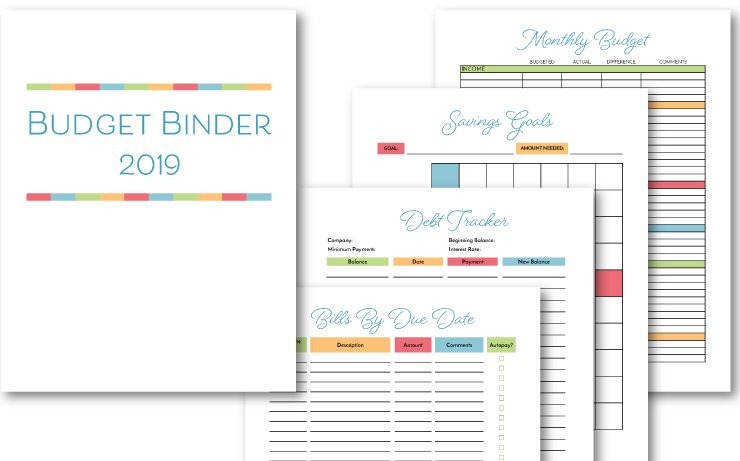

One way is with Cents and Order personalized budget tools. It’s easy to get your finances in order with our free, printable Budget Binder! Read on for more information on the Budget Binder printables and how they can help you set up a successful budget.

Table of Contents

Cents and Order Free Budget Binder Printables

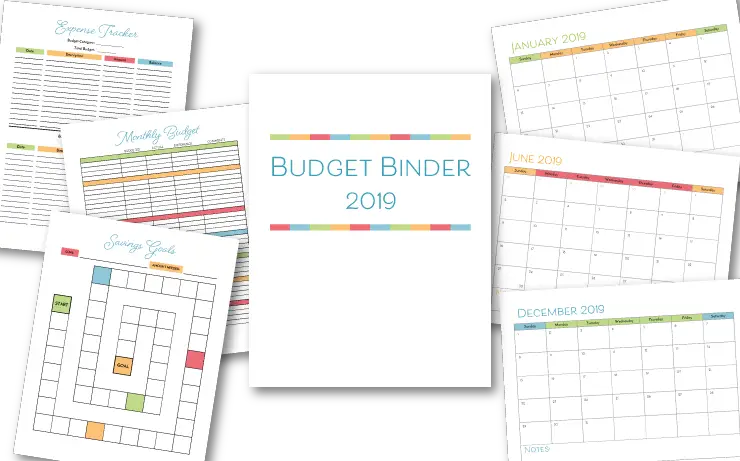

The Cents and Order free Budget Binder Printable includes 20+ pages of financial printables to help you create your 2019 budget. Using it as explained here can help you avoid common budgeting mistakes. The free worksheets you’ll get with the binder include:

- free budgeting worksheets

- bill payment checklist

- savings trackers

- debt tracking sheets

And many more. Note that you’ll only see explanations for 12 printables in this article, but that’s because some printables have more than one worksheet you’ll need to print out. Ready? Keep reading: We’ll share complete instructions on how to print and use your free Cents and Order Budget Binder printables.

How to Make Your Budget Binder:

As I’ve mentioned, our free Budget Binder printables are a great way to get your finances organized. Use the included worksheets to track your budget, grow your savings, pay off your debt and more.

Let’s start with a list of supplies you may want to use to help you better organize your budget and your printables:

- Binder: D-ring binders tend to work better. A good binder will help you keep your printables organized.

- Divider Tabs: Divider tabs are great for keeping different areas of your finance binder separate, such as debt, bill paying, or savings.

- Binder Pockets: Instead of filing my bills in several different files in my filing cabinet, I just use these pockets. At the end of the year, I empty the pockets out and place all the statements and bills in a separate file. Binder pockets are also great to store your bills that are awaiting payment.

- Zipper Pouch: Zipper pouches work great to store your bill paying supplies like envelopes, stamps, and your checkbook.

I’ve created the Budget Binder printables with a bright and energetic color theme. Would you rather print them without the colors? No problem! Just set your printer to print in black and white if you’d rather have something less colorful or want to save your colored ink!

Here are the 20+ Printables for your Finance Binder

The Cents and Order Budget Binder printables contain everything you need to manage your money better! You may find that you don’t need all of the printables for your budgeting situation or style – and that’s okay? Just customize your Budget Binder with the printables that work for your personal financial situation.

This free download includes the following printables (some categories have more than one page):

- Cover Page

- Bill Payment Checklist

- Bills by Due Date

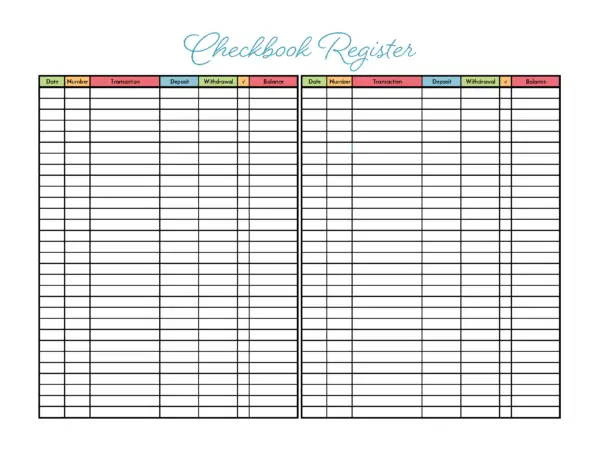

- Checkbook Register

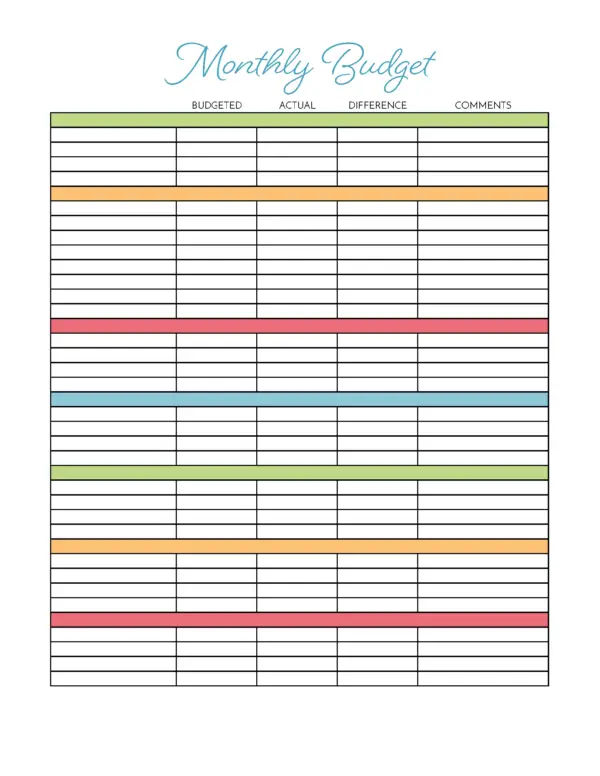

- Monthly Budget

- Blank Budget Template

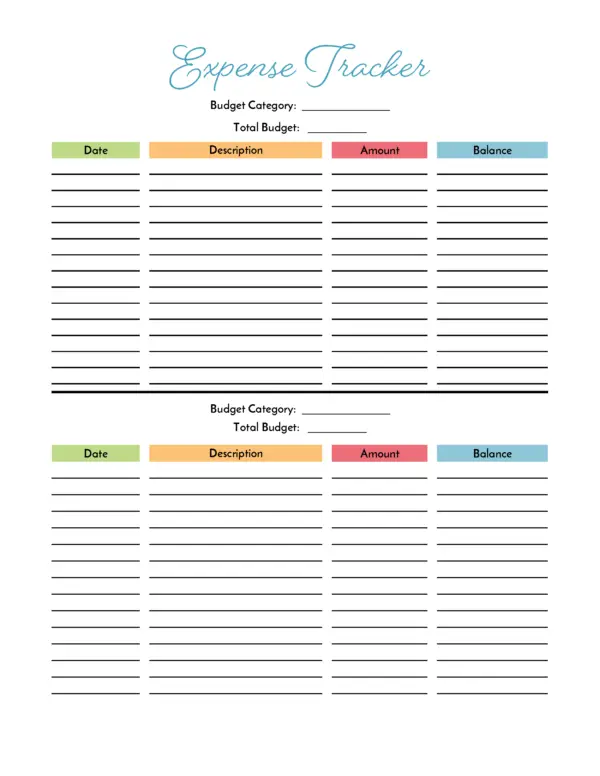

- Expense Tracker

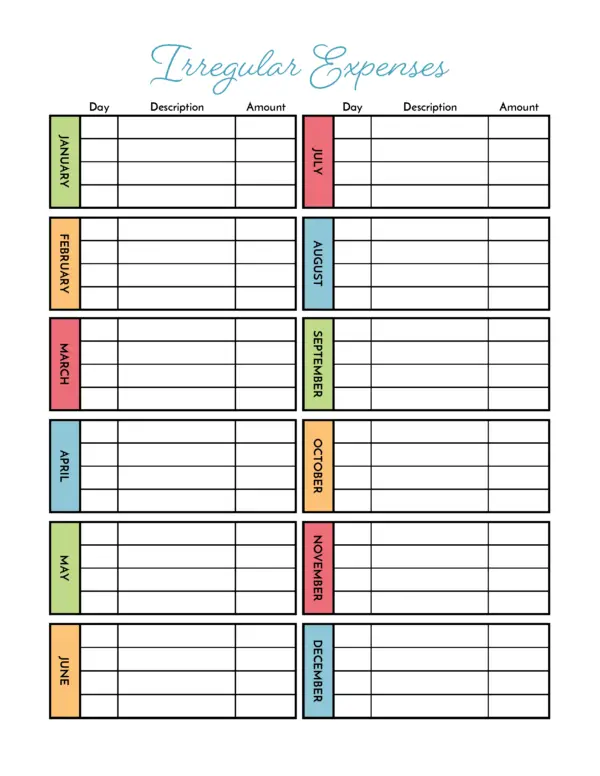

- Irregular Expense Tracker

- Blank Savings Goal Tracker

- $1000 Savings Tracker

- Debt Payments Tracker

- Debt Payoff Progress Tracker

- Matching 2019 Monthly Calendar

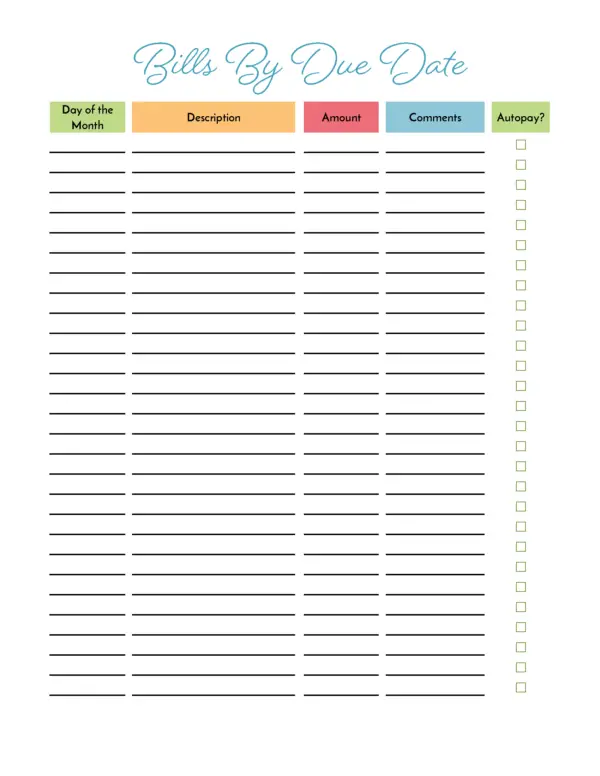

Bills By Due Date

This first printable helps you keep track of all of your bills. It’s a great reference for your binder. It records the date your bills are due, the name of the bill, the amount due, whether the bill is set up on autopay and more.

This printable form will help ensure you know what is due, when it’s due and whether or not you need to make a manual payment. Use this form to help create your budget and to ensure you don’t make any of your payments late.

It can be helpful to list all your bills in due date order. Then you always have a quick reference to peek at and see what bills are coming up next.

Don’t forget to include quarterly, semi-annual, and annual bills. (Such as sewer, trash, insurance premiums, and subscriptions)

I like to use the comments section to note if a bill is a fixed or variable amount. Also, if you have a bill that is quarterly (or less frequent), you can use this area to make note what months have payments due.

For bills that vary, you can put an estimate or average amount. Then you can put that average dollar amount in a separate bank account or cash envelope to ensure you’ve got the money to pay when the actual bill comes due.

Bill Payment Checklist Printable

The Bill Payment Checklist is my favorite printable of all! It lists all of your bills and is a great way to remember what needs to be paid. It will provide you a snapshot of what bills you have upcoming and a way to track your payments.

This printable worksheet can help you even if you are great about paying the bills when they come in. For example, what happens if you don’t get a bill? It gets lost in the mail or whatever. Using a Bill Payment Checklist will remind of you of all your bills – even if the bill gets lost.

Don’t forget to include bills that are set up to pay automatically.

It’s helpful to list bills in due date order on your bill pay tracker so you can see what’s due next.

You can include bills that are quarterly or less too. Just put an X through or other mark on the months where no payment is required.

I like to include everything on here, even if there isn’t always a monthly bill. For example, I use a Kohl’s card strictly to take advantage of discounts and pay in full when the bill comes. Even though most months do not have a bill, I include it on my checklist so I don’t miss paying if I use the card in a given month.

Checkbook Register Printable

Our free printable checkbook register is created to look just like the ones that come with your checkbook -only prettier! I’ve included a checkbook register form simply because it can be easier for having all of your financial information in one place.

This way you don’t have to go back and forth from your Budget Binder to your checkbook to pay the bills.

Monthly Budget Template

Here is the actual budget for you’ll use to create your monthly budget. It also has spaces for budgeted expenses vs. actual expenses. This way you can use this budget template to track how you did compared to your budget. There’s a “notes” section to so you can explain any variances.

For instance, let’s say you had a really high expense one month in the area of groceries due to a gathering you held. You can write that in your “notes” section so you remember why your budget was off track that month.

RELATED: 6 BUDGETING METHODS EXPLAINED-HOW TO CHOOSE THE BEST SYSTEM FOR YOU

Here are some ideas on what you’ll want to include for each category. This isn’t an all-inclusive list, but hopefully gives you a starting point. Just because I’ve listed an expense, doesn’t mean you need to include it in your budget. If it doesn’t apply to your family that’s okay. Write your budget in the way that works best for you.

Budget Category Suggestions

Income Source Ideas:

- Paycheck

- Bonus

- Child support

- Alimony

- Social Security/retirement income

- Self-employment income

Savings Goal Ideas:

- Emergency Fund

- Retirement

- College

- Vacation

- Other

Home Expenses:

- Mortgage

- Rent

- Insurance

- Taxes

- Repairs/Maintenance

- Electric

- Gas

- Water

- Sewer

- Trash

- Cable/Satelite

- Netflix/Hulu/etc

- Internet

- Phone

- Cell Phone

- Alarm/Security

Debts (break them down by specific credit card, student loan, etc.):

- Student Loans

- Credit Cards

- Personal Loans

Auto Expenses:

- Car payment

- Insurance

- Fuel

- Repairs/maintenance

- Tolls

Living Expenses:

- Medical premiums

- Charity

- Clothing

- Childcare

- Haircuts/Beauty

- Entertainment

- Gifts

- Pet

- Gym

- Medical co-pays

- Medications

Again, these are simply suggestions. Create your specific income and spending categories in a way that works for you. Don’t forget to include annual and semi-annual or bi-monthly expenses. Divide them by 12 to get your monthly budgeted amount for each one.

Blank Budget Worksheet

This printable is same as the one above with one exception. It’s blank instead of coming with pre-written categories so you can better decide how to customize categorize your expenses.

Expense Tracker

The expense tracker is a great way to monitor a particular category of your budget. You can use one for each area of your budget or just for those trouble spots.

I use these to track categories that have several purchases throughout the month. For instance, categories that are easier to get into budget trouble if not monitored closely. Categories like food/groceries, dining out/entertainment, and auto fuel are good examples of categories to watch.

As an example, with groceries I write down each grocery purchase here. In the description area I’ll list whether it’s a basic monthly shopping trip, a random stock-up run or a special occasion trip. For instance, when I’m getting groceries for a gathering or for bringing a meal for a needy family.

I don’t use them for budget categories that would only have one item, such as electricity. However, if you budget all of your utilities as one big category, then this tracker would keep you on target too.

Breaking down these categories where you spend multiple times during the month helps you better know what your regular budget is. That way you can adjust your numbers accordingly if you’re continually finding your budgeted vs. actual expenses are conflicting. Better yet, it’ll help you know why the numbers aren’t matching up.

Irregular Expenses Worksheet

One-off expenses can really throw off your budget. Be prepared and use this sheet to remind you of those irregular expenses that you need to work into your monthly budget.

Some common items you might want to include:

-

- Car registration/inspection

- Birthdays/anniversaries (gifts and/or party costs

- Kid’s activities (scouts, sports, etc)

As I mentioned earlier, it can be helpful to divide the annual cost of these types of expenses by 12. Then just put the monthly amount for each one into your regular budget.

Transfer the allotted monthly budget amount for each one to a separate bank account. Or, take the money out and store it in an envelope if you prefer to use the cash envelope system as a part of your budget.

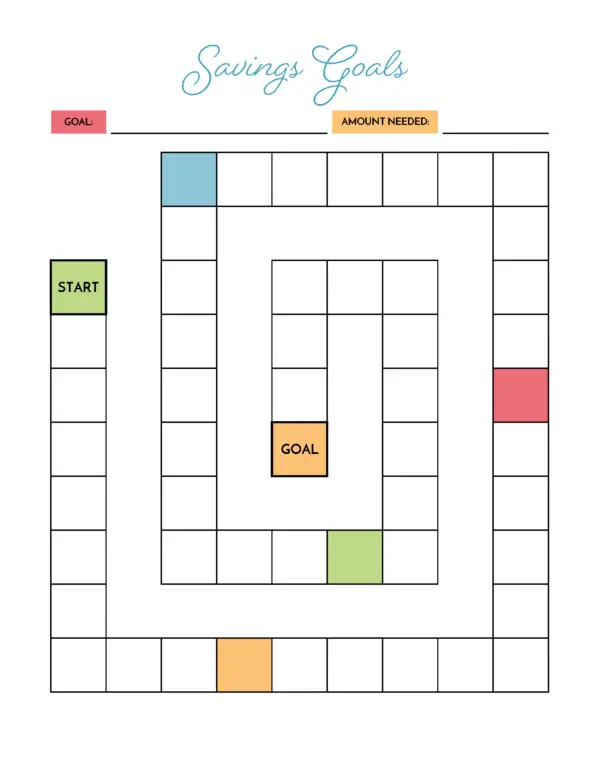

Blank Savings Goal Tracker

This is a fun printable you can use to track your progress on a particular savings goal.

Whatever your goal amount is, divide it by 50 to get the increments for your boxes. For example, if my goal was $500, my boxes would be increments of $10.

I’ve left the boxes blank so you can fill in the dollar amounts that correspond to your goal.

You can visually track your progress by shading boxes as your savings reaches the targeted dollar amounts. The colored boxes let you know when you’ve hit 20%, 40%, 60%, and 80% of your goal.

Use this sheet to track savings goals for things such as:

- vacations

- debt payoff goals

- emergency fund building

- house down payment savings

- car purchase savings

And more. The 50 squares this worksheet contains will give you over four years of goal-reaching time. If you need more, just create an additional worksheet for the additional squares when your first one gets filled up.

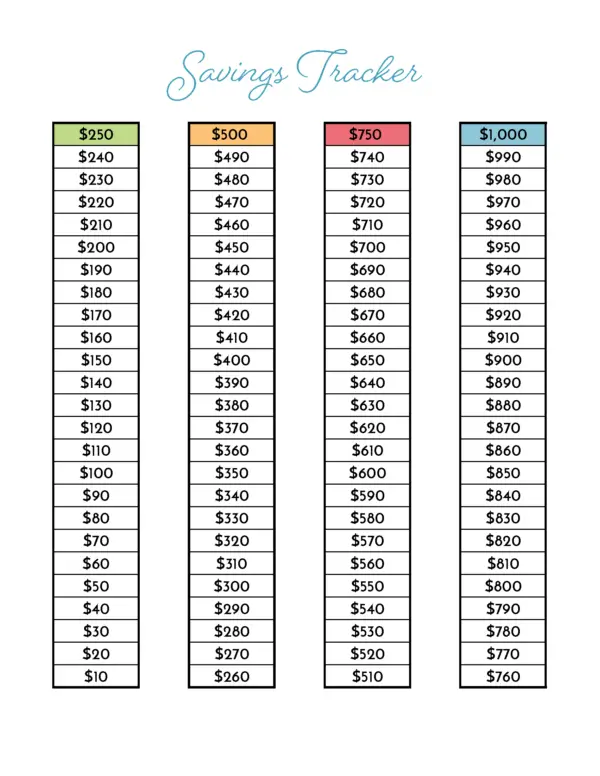

$1000 Savings Tracking Sheet

Financial expert Dave Ramsey talks about saving a starter emergency fund before you begin paying off debt. An emergency fund is a separate savings account. It’s specifically meant to cover unexpected expenses such as a job layoff. Ramsey recommends a full funded emergency fund contain 3 to 6 months’ worth of expenses.

Are you working on building your starter emergency fund? If so, you can keep track of your progress with this visual tracker. Shade the boxes for each $10 you get saved up. That way you can track your starter emergency fund no matter what your budget. Most anyone can save at least $10 during the month.

And if that’s all you can save, don’t allow yourself to be discouraged by that. Anything saved will help cover unexpected expenses that might come your way. While we’re on the subject of emergency funds, be sure to remember that there are some things that emergency funds are not meant to cover, such as:

- annual or semi-annual expenses such as car insurance

- new vehicles or vehicle repairs (you know you’ll need these things eventually – they should be in your budget and saved separately for)

- unexpected “deals” on things you want or need (these items should also have a separate savings account)

Using your emergency fund for true emergencies such as job layoffs or medical expenses not covered by a Health Savings Account will ensure you can save more in the fund.

RELATED: 9 CREATIVE SECRETS TO SURVIVE WHEN YOU ARE BROKE

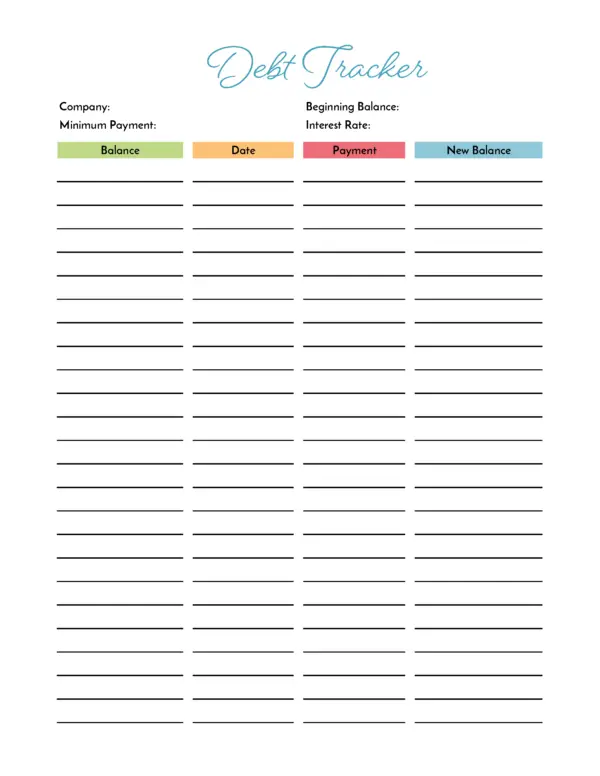

Debt Payments Tracking Printable

The Debt Payments Tracking sheet helps you to be able to monitor your progress on your debts. Print one of these sheets out for each debt you have.

Keep track of your payments and the new, lower balance each and every month. Bonus: Looking back over your year’s progress can be very motivational.

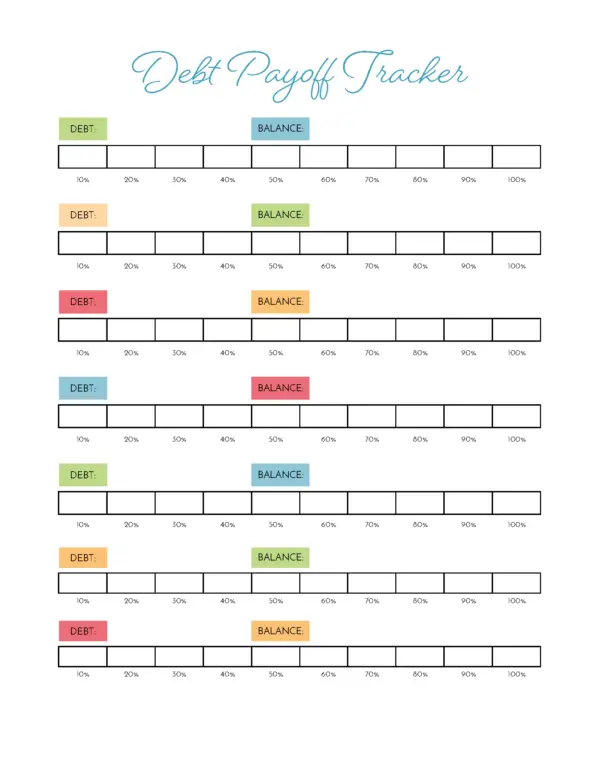

Debt Payoff Progress Tracker

Would you like a visual to track your debt payoff progress? Use this Debt Payoff Progress Tracker printable.

Fill in the boxes with the increments that match up with the percentages on the printable. You’ll shade the boxes as you pay off that much of your debt. Visuals can be very helpful and motivating during what is often a long debt payoff process.

Use them to help you stay on track as you work to achieve your debt payoff goals. In addition, remind yourself why you want to be debt free and what debt freedom will mean for you/your family. Debt payoff can be difficult, but using tools like the Debt Payoff Progress Tracker printable can help.

RELATED: FIVE SIMPLE SECRETS TO PAY OFF DEBT FAST

Evergreen Blank Calendar Pages

The Budget Binder wouldn’t be complete without coordinating calendar pages. You may find it helpful to track pay days and bill due dates on the calendar pages.

Or, use it for regular household scheduling or to note special financial target dates. For instance, you could use a calendar page to note when you’ll be debt free. Or when you’ll reach your emergency fund goal or other savings goals.

Make a colorful notation for that special day. Then celebrate accordingly. Or just use the calendar pages to have a nice, free calendar for home use.

Summary

A good budgeting system really can help you make the most of your finances. Whether you need a major financial overhaul, or just some help keeping your money organized, the Cents and Order free budgeting printables can help you.

You can use them to help transform your finances into a picture that helps you reach all of your monetary goals. Use all of the printables, or just the ones that work for your financial needs.

Download them today for a fun way to help improve and track your personal finances. Have you ever used any kind of budgeting system? What do you think of our free Budgeting printables? Feel free to leave your comments on our Facebook page.